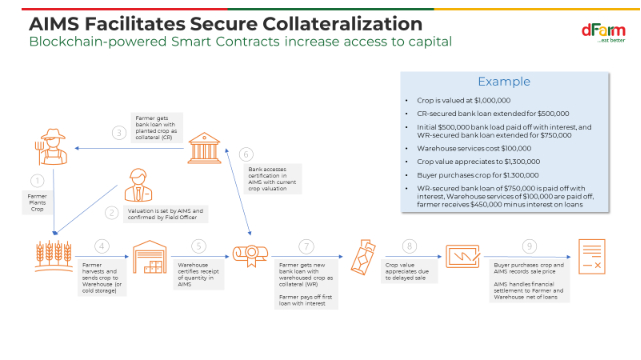

Unlocking Agricultural Finance: Blockchain Smart Contracts for Tracking Crop and Warehouse Receipts

The agricultural sector forms the backbone of the global economy, contributing significantly to GDP and providing sustenance for billions. Yet, it grapples with immense challenges, among which access to working capital is of paramount importance. Physical assets like crops and warehouses are crucial in agricultural financing, but their usage as collateral has been fraught with complications.

Emerging technologies such as blockchain, particularly smart contracts, present revolutionary solutions to these challenges. By providing a transparent, secure, and efficient system to track crop and warehouse receipts, blockchain can facilitate the collateralization process, thereby easing access to working capital. In this comprehensive blog, we’ll dive into the potential of blockchain and smart contracts in transforming agricultural finance.

Blockchain and Smart Contracts: A Brief Primer

Before exploring the applications of these technologies, let’s demystify them first. A blockchain is a distributed, decentralized digital ledger where transactions are anonymously confirmed and recorded. Its decentralized nature ensures that recorded data becomes immutable, i.e., resistant to manipulation or deletion.

Smart contracts, integral to blockchain technology, are self-executing contracts with the agreement terms encoded directly into lines of code. They reside on the blockchain and activate automatically when predetermined conditions are met, eliminating the need for third-party intermediaries while offering unparalleled security and efficiency.

Transforming Collateralization with Blockchain

Traditional methods of collateralizing crop and warehouse receipts involve complex paperwork, physical inspections, and a significant reliance on intermediaries. These processes are labor-intensive, expensive, and prone to errors and fraudulent activities. Blockchain-based smart contracts offer a promising alternative characterized by transparency, security, and efficiency. Here’s how:

- Transparency and Real-Time Tracking:Blockchain provides an immutable record of crop and warehouse receipts visible to all network participants. This transparency boosts trust among lenders, borrowers, and regulators. Any updates to these records are immediately reflected and can be viewed in real-time by all parties, allowing efficient asset tracking and reducing the risks associated with collateralization.

- Automated Execution:Smart contracts allow the automatic execution of agreements. For example, a loan repayment can be initiated automatically by the smart contract once a farmer sells their crops or when a specified period ends. This automaticity eliminates potential disputes and ensures compliance with the agreement.

- Reduced Fraud:Traditional systems are vulnerable to fraudulent activities such as issuing duplicate receipts or misrepresenting asset quality. However, with blockchain’s immutability, a transaction, once recorded, cannot be altered or deleted. This attribute, combined with the transparency offered by blockchain, significantly minimizes the risk of fraud.

- Lower Costs:By dispensing with intermediaries and reducing the verification and execution time of contracts, blockchain smart contracts can drastically cut the costs linked to collateralizing crop and warehouse receipts.

Enabling Access to Working Capital

The use of blockchain and smart contracts can revolutionize access to working capital for farmers and agribusinesses. Here are the primary ways this can happen:

- Increased Trust Among Lenders:The enhanced transparency and security brought about by blockchain technology can motivate lenders, including banks and microfinance institutions, to provide loans using crop and warehouse receipts as collateral, thereby widening the pool of available working capital.

- Improved Loan Repayment Rates:Automated repayments through smart contracts can enhance loan repayment rates, rendering the agriculture sector more appealing to lenders and investors.

- Inclusion of Small-Scale Farmers:Small-scale farmers often face difficulties in accessing working capital due to perceived risk and high service costs for loans. By reducing these costs and risks, blockchain technology can integrate these farmers into the formal financial system, increasing their access to working capital.

- Global Market Access:Blockchain can help farmers get a better price for their produce by providing proof of sustainable farming practices to foreign markets, where consumers might be willing to pay a premium for such products. This improved access to global markets can result in increased working capital.

Looking Ahead: Challenges and Opportunities

While the potential of blockchain and smart contracts in agricultural finance is immense, the implementation of such systems does come with challenges. These include the need for robust technological infrastructure, the development of suitable legal frameworks, and the requirement for user education.

However, with technology rapidly advancing and more stakeholders recognizing blockchain’s benefits, these obstacles are not insurmountable. Cooperative efforts from governments, tech companies, and the agricultural community can aid in addressing these challenges, making this technological revolution a reality.

To sum up, blockchain technology and smart contracts have the potential to reshape the financial dynamics of the agriculture industry. By ensuring transparency, reducing fraud, lowering costs, and improving loan repayment rates, this technology can address many of the hurdles faced by farmers and agribusinesses, leading to sustainable and inclusive growth. The future of agriculture could very well be on the blockchain.

About dFarm

dFarm is a leader in supply chain optimization for the agriculture sector. Access to working capital by participants in the ag supply chain is a critical and chronic problem.

With dFarm, supply chain participants can use Smart Contracts to record and validate collateralized debt obligations (CDOs) like Crop Receipts and Warehouse Receipts, that can be used as collateral for working capital loans.

Real-Time Whole Chain Tracing

Risk is unmanageable without visibility. dFarm’s Precision Trace utilizes dFarm’s deep data collection technologies to provide tracing back to the specific sources at the farm and lot level, and tracing forward to all recipients.